Introduction to This Article:

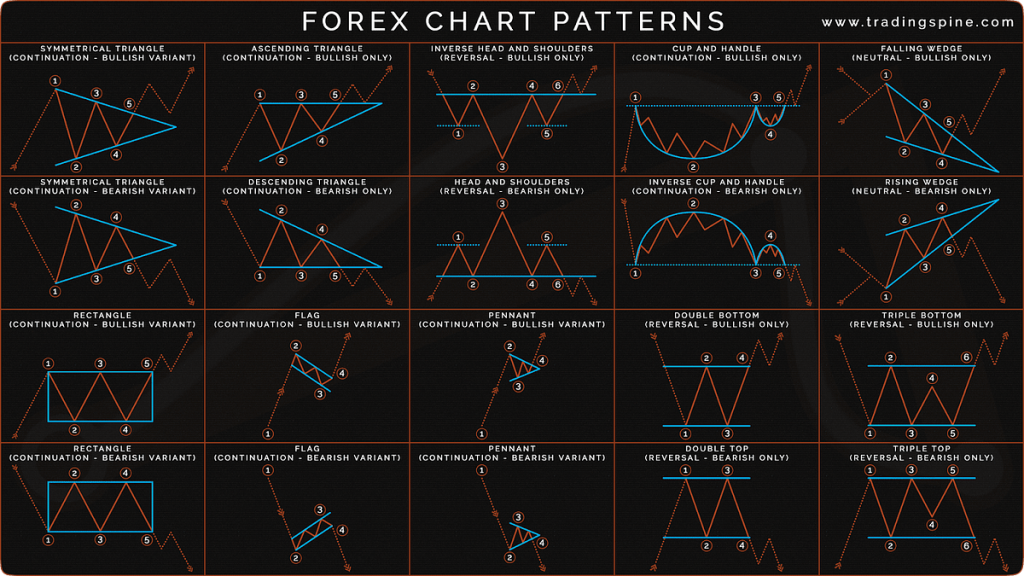

Trading chart patterns are highly effective tools utilized by technical analysts to identify promising trading opportunities. These patterns offer valuable insights into market trends, empowering traders to make well-informed decisions. In this article, we will explore the Top 5 Trading Chart Patterns that every trader should familiarize themselves with and comprehend.

Top 5 Trading Chart Patterns – Head and Shoulders Pattern:

The head and shoulders pattern signals a trend change with three peaks (head and shoulders). Confirmation occurs when the price breaks below the neckline. Traders use it for short positions, anticipating a bearish trend reversal.

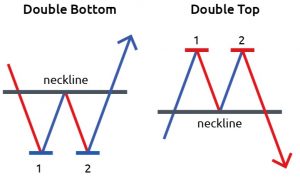

Top 5 Trading Chart Patterns – Double Top and Double Bottom Pattern:

Double-top and double-bottom patterns indicate trend reversals. A double top forms with two peaks of similar heights, followed by a break below the neckline. However, a double bottom forms with two troughs of similar depths, followed by a break above the neckline. Furthermore, traders use these patterns to identify entry and exit points.

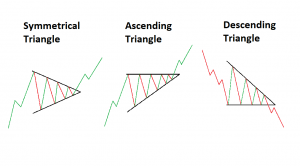

Top 5 Trading Chart Patterns – Triangle Pattern:

Triangle patterns show consolidation before the price resumes its trend. Types include ascending, descending, and symmetrical triangles. Ascending triangles have a flat upper trendline and a rising lower trendline. While descending triangles have a flat lower trendline and a descending upper trendline. On the other hand, Symmetrical triangles have converging trendlines. Traders seek breakouts to predict price movement.

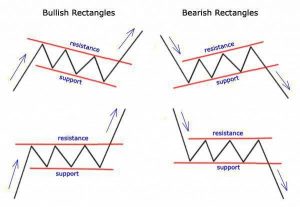

Top 5 Trading Chart Patterns – Rectangles and Flags:

Rectangles and flags are continuation patterns maintaining the current trend. Rectangles have horizontal trendlines as support and resistance. Traders enter positions when the price breaks above or below the trendlines. Flags are small rectangles after a price move, signaling a temporary pause before the trend resumes.

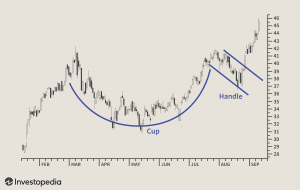

Top 5 Trading Chart Patterns – Cup and Handle Pattern:

The cup and handle pattern is a bullish continuation pattern. It resembles a cup with a handle and signifies a temporary consolidation before the price resumes its upward movement. On the other hand, Traders look for a breakout above the handle’s resistance level as a potential entry point.

Conclusion:

In conclusion, Mastering chart patterns is crucial for traders. However, this article covers the top 5 patterns: head and shoulders, double top and double bottom, triangles, rectangles and flags, and the cup and handle pattern. Moreover, these patterns offer insights into trends and trading opportunities. Studying them helps traders identify entry and exit points for success in the markets.

Learn More – Information Courtesy