Introduction to This Article:

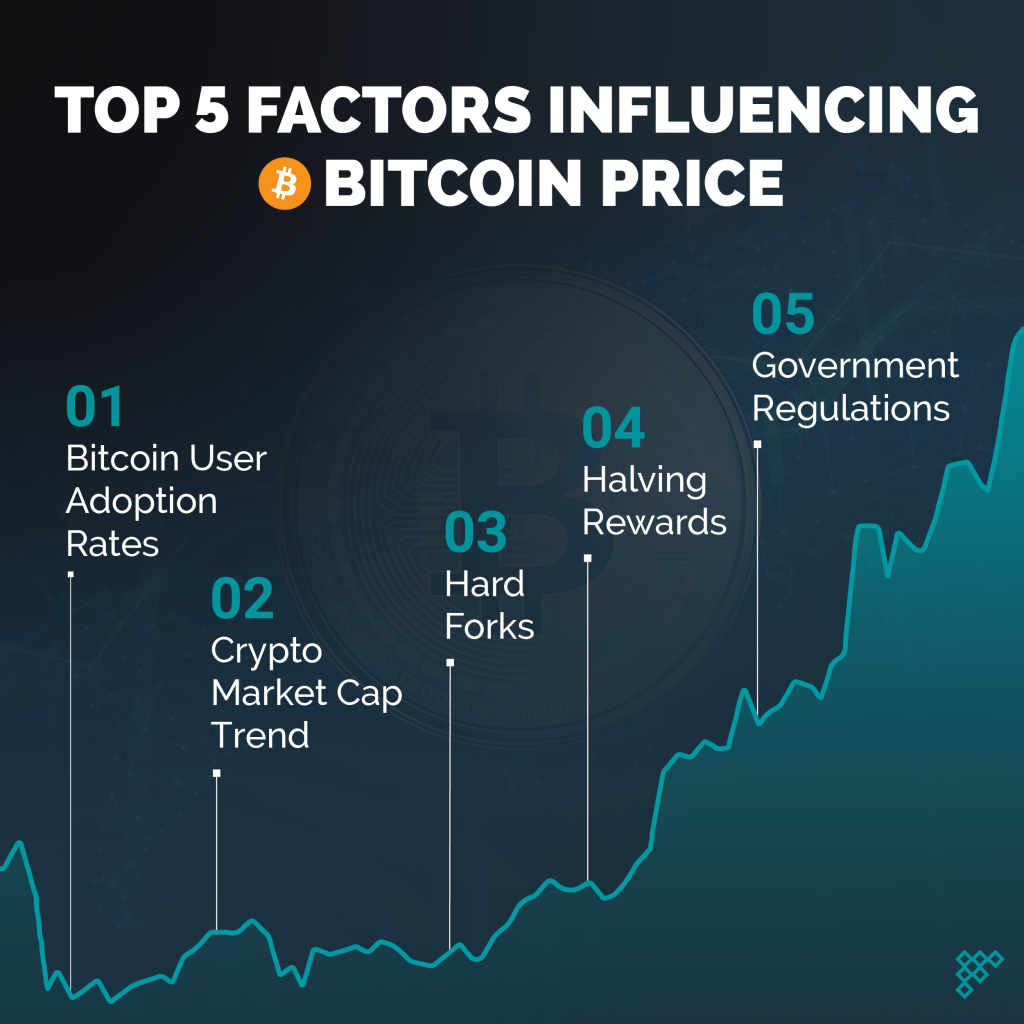

Cryptocurrency prices are highly volatile and can change rapidly within short timeframes. Numerous factors contribute to these price fluctuations. Investors understand the market by studying trends, news, and events. They use this knowledge to make choices about their investments. This article will explore the top 5 factors influencing cryptocurrency prices.

Top 5 Factors Influencing Cryptocurrency Prices – Market Demand and Adoption:

Cryptocurrency prices depend on demand. Prices rise when there is increased usage, acceptance, and institutional interest in cryptocurrencies. Conversely, prices can decline when there is decreased demand or a lack of adoption.

Top 5 Factors Influencing Cryptocurrency Prices – Regulatory Environment:

Regulations greatly impact cryptocurrency prices. Governments and regulatory bodies have different approaches to cryptocurrency regulation. When regulations are positive and clear, it can create a good environment for cryptocurrencies, which may lead to higher prices. On the other hand, when there are strict regulatory measures or an uncertain regulatory environment, it can negatively impact market sentiment and result in lower prices.

Top 5 Factors Influencing Cryptocurrency Prices – Technological Developments and Upgrades:

Technological advancements in the cryptocurrency ecosystem can significantly affect prices. Upgrades to blockchain networks and new features attract investor attention and create positive sentiment. Innovations in decentralized finance (DeFi) and non-fungible tokens (NFTs) also generate excitement and drive demand, potentially influencing prices.

Top 5 Factors Influencing Cryptocurrency Prices – Market Sentiment and Investor Confidence:

Market sentiment and investor confidence are vital factors affecting cryptocurrency prices. Regulatory advancements and institutional adoption drive prices up, while security breaches, strict regulations, or market instability cause declines. The overall mood of investors, traders, and the media significantly influences cryptocurrency prices.

Top 5 Factors Influencing Cryptocurrency Prices – Global Economic Factors and Events

Economic factors and global events influence cryptocurrency prices. Instability, inflation, or currency devaluations in traditional markets can drive people to cryptocurrencies, increasing demand and prices. Geopolitical events, regulations, and financial market movements also create volatility, impacting cryptocurrency prices. Staying updated on the global economy is essential to understand their effects on cryptocurrencies.

Conclusion

To sum up, cryptocurrency prices are influenced by market demand, regulations, technology, sentiment, and global economics. However, To navigate the market well, investors and traders should monitor these factors, stay informed, and be cautious. However, it’s important to note that cryptocurrencies are volatile and driven by guesswork. Although, research and caution are essential in this dynamic market.

Learn More – Information Courtesy