Introduction to Top 5 Crypto Indicators For Beginners:

As a beginner in cryptocurrency trading, it’s crucial to know which indicators to use. The top 5 crypto indicators are RSI, MACD, EMA, MA, and VOL. They can help you decide when to buy or sell and understand the market. Remember, no indicator can predict the market, so it’s best to research and use multiple indicators.

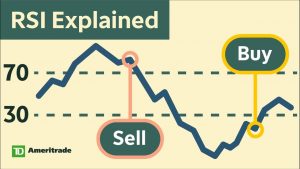

Top 5 Crypto Indicators: Relative Strength Index (RSI)

The RSI is a tool used in crypto trading to measure the strength of an asset’s price action. It goes from 0 to 100 and compares average gains and losses over time. If the RSI is above 70, it’s overbought, and below 30, it’s oversold. Traders can use this to find buy or sell signals when the RSI crosses these levels.

Top 5 Crypto Indicators: Moving Average Convergence Divergence (MACD)

The MACD is a popular indicator in crypto trading that measures the relationship between two exponential moving averages of an asset’s price. It has a MACD line and a signal line that can signal trend reversals and buy/sell opportunities. If the MACD line crosses over the signal line, it’s bullish, and if it crosses below, it’s bearish.

Top 5 Crypto Indicators: Moving Averages (MA)

Moving Averages (MA) is a basic yet powerful technical indicator that calculates the average price of an asset over a specified period. MAs can help identify support and resistance levels, and potential trend reversals. A crossing of an asset’s price above its MA can indicate a bullish trend, and a crossing below can indicate a bearish trend.

Top 5 Crypto Indicators: Exponential Moving Averages (EMA)

The EMA is a moving average that gives more importance to recent price action than older price action. It can react faster to price trend changes than other types of moving averages. Traders use EMAs to find support and resistance levels and possible trend reversals.

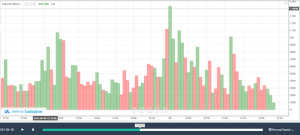

Top 5 Crypto Indicators: Volume (VOL)

Volume (VOL) measures the number of assets traded during a specific time. However, Traders use it to confirm price trends and detect possible trend reversals. If an asset’s price increases with high volume, it’s a bullish signal, and if it decreases with high volume, it’s a bearish signal.

Conclusion:

In summary, RSI, MACD, EMA, MA, and VOL are important technical indicators for beginner crypto traders. While they can identify buy/sell signals and confirm trends, no single indicator can predict market movements accurately. It’s recommended to use multiple indicators and conduct comprehensive research before investing.

Additionally, technical analysis alone is not enough for success; fundamental analysis, market sentiment, and news events also play a significant role. Therefore, beginner traders should develop a well-rounded approach to investing in the cryptocurrency market to increase their chances of success.

Learn More – Information Courtesy